April 26, 2022 (Silver Spring, MD) – Markets have turned decidedly bullish for all three major organic crops since September 2021 as supply outlooks have become increasingly uncertain. Despite all prices moving generally higher, the ability of these markets to maintain their current price levels will hinge on a variety of factors over the next year as discussed in the Spring 2022 Mercaris Commodity Outlook.

“A major element shaping the global agricultural outlook - as well as U.S. organic markets - is the ongoing incursion of Russian military forces into Ukraine. In addition to impacting grain, fuel and fertilizer prices globally, this situation has created a tremendous amount of risk for U.S. organic corn and oilseed imports throughout the next year,” says Ryan Koory, Vice President of Economics with Mercaris. “In addition to Ukrainian-Russian conflict, drought conditions in both Argentina and Canada could provide further restrictions on U.S. imports.”

Over 2020 and through 2021, Argentina accounted for 15 percent of U.S imported organic oilseeds and their derivatives as well as 69 percent of U.S. organic corn imports. In Canada, the drought risk mostly impacts organic wheat supplies as persistent drought conditions are primarily located across the prairies. Ninety percent of agricultural land across the Canadian prairies was identified as experiencing drought conditions as of February 28, 2022, according to the Canadian drought monitor. Persistent drought conditions extend into the U.S. with 87 percent of Montana - the largest organic wheat producing state - under drought conditions as of March 29, 2022, according to U.S. drought monitor data. If these conditions persist, 2022 is set to become the second consecutive year of reduced organic wheat production as a result.

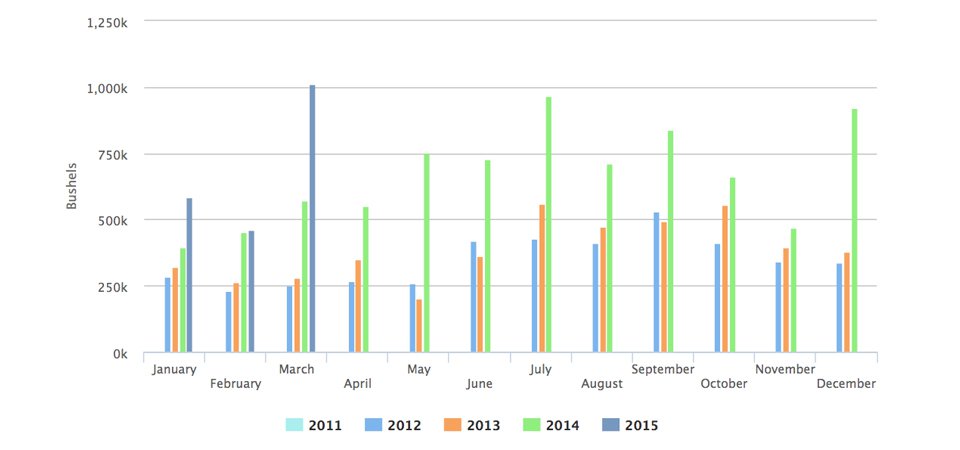

“In contrast to wheat, both organic corn and soybean production have expanded significantly. Mercaris estimates that organic corn and soybean production increased 9 percent and 25 percent from the prior year respectively over the 2021 harvest,” says Koory. “Despite the risk to imports, gains in U.S. organic corn production are expected to push total U.S supplies higher. This is partly due to organic feed demand slowing over 2021/22, as higher organic feed prices trim industry expansion.”

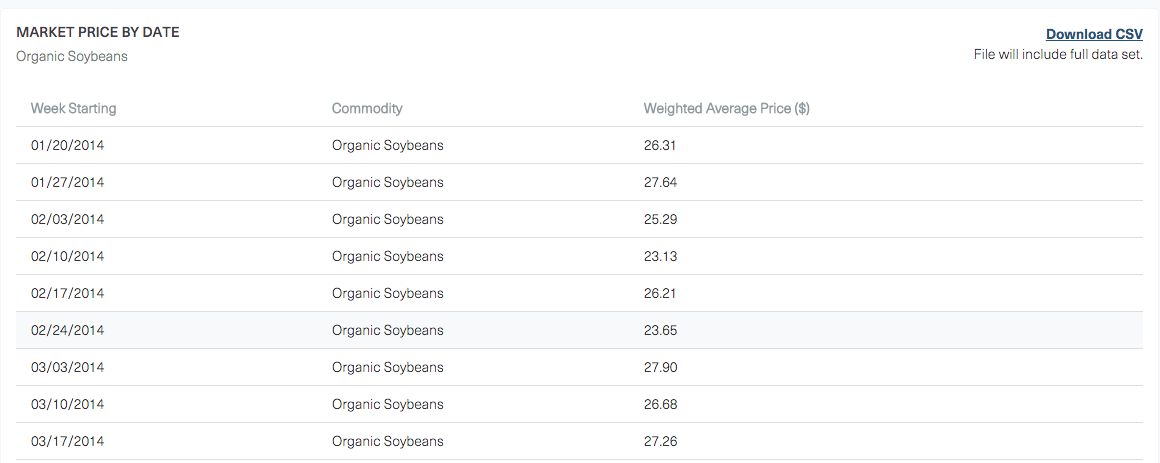

Organic soybean supplies are expected to contract over 2021/22 as the industry adjusts to the loss of large organic soybean meal imports from India. Mercaris estimates U.S. organic soybean meal feed demand will decline 3 percent over 2021/22.

The information above is summarized from the Spring 2022 Mercaris Commodity Outlook. To find more details and information on other organic and non-GMO markets, visit www.mercaris.com.

About Mercaris

Mercaris has helped its customers capitalize on the growing demand for organic and non-GMO agriculture by providing market intelligence, analysis and trading services exclusively for the identity-preserved agriculture industry. Mercaris hosts the largest organic and non-GMO grain and oilseed market survey across the U.S. as well as Canada and recently launched an organic dairy initiative. The company also maintains a trading platform for organic and non- GMO commodities. With a dynamic combination of data, insights and technology, our customers can access solutions for every challenge. For more information visit: www.mercaris.com.